GAP: What is it?

Old Republic Guaranteed Asset Protection, also known as GAP, helps cover some of the financial gap between the actual cash value of a vehicle and the payoff amount of the loan or lease in the event of a total loss.

Old Republic Guaranteed Asset Protection, also known as GAP, helps cover some of the financial gap between the actual cash value of a vehicle and the payoff amount of the loan or lease in the event of a total loss.

- Serving the New and Pre-owned Vehicle Market

- Terms up to 84 months and up to 150% of MSRP

- Available for Light Commercial Use Vehicles

- Protection for Vehicles Valued up to $100,000

- Covers Losses to a Maximum of $50,000

- Coverage of the Vehicle’s Primary Insurance Deductible up to $1,000

Our Plans Offer a Direct Relationship with the Insurance Company-

There is No Third Party Administrator!

How it Works: Are You Protected?

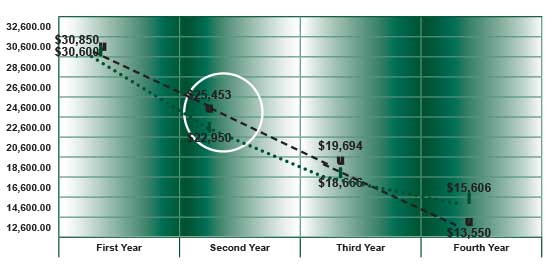

This graph illustrates your estimated limited liability during the term of your loan.

This graph illustrates your estimated limited liability during the term of your loan.

| Loan/Lease Term |

60 months |

| Loan/Lease Amount |

$32,600 |

| Loss Occurs Second Year of Loan |

| Actual Cash Value |

$22,950 |

| Loan/Lease Payoff |

$25,453 |

| What You Will Still Owe |

$2,503 |

| Insurance Deductible |

$1,000 |

| Potential Out-of-Pocket |

$3,503 |

| GAP Payment to Dealer/Lender/Lessor |

$3,503 |

|

| Your Net Cost |

$0 |

What’s a “Total Loss”?

ORIAS considers your vehicle a “Total Loss” when your Primary insurance company determines that the cost of repairs exceeds the value of the vehicle. In the absence of Primary insurance, the covered vehicle must be available for the GAP Administrator’s inspection to verify that it is a total loss and determine its Actual Cash Value immediately prior to the Date of Loss.

If your vehicle is declared a total loss, an ORIAS adjuster will ask you to provide:

- A copy of the Primary Insurance company claim settlement check(s), settlement worksheet and Actual Cash Value evaluation.

- A copy of the police report.

- Proof of proceeds recovered from cancellation of refundable items, such as a service contract, credit insurance or other similar items.

- A copy of the Financial Agreement.

- Documentation from the Financial Institution detailing the payoff as of the Date of Loss.

- A copy of the Bill of Sale if provided to the Buyer.

- A copy of the complete history of the Financial Agreement showing all payments and transactions.

- GAP Claim Reporting form (provided by the Program Administrator and also available here).

- Vehicle Option Form completed by the Buyer (provided by the Program Administrator and also available here).

For questions regarding coverage for a total loss, call one of our

customer service representatives at (800) 331-3780.